Make in Vietnam – Phần 1: Thực trạng ngành IT Outsourcing tại Việt Nam

2024년 04월 02일

Ngân hàng số hàng đầu Việt Nam

2024년 04월 02일When it comes to digital innovation in Asia, Vietnam presents itself as a particularly interesting case, with its large digital population, high internet penetration rate, and approximately 125 million mobile phone users. Along with COVID-19, these factors have led to a dramatic increase in the usage of digital financial services in Vietnam over the past two years, especially with online and mobile payments as well as e-commerce.

In fact, in the first quarter of 2020, online payments shot up by 76%, and the total amount of payments showed a 129% increase compared to 2019.

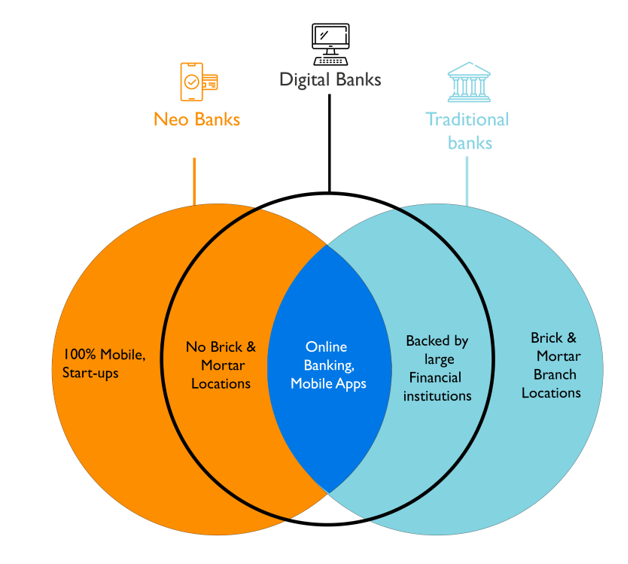

Key elements of digital banks (Source: tavsoft)

This boom in digital financial services is being capitalized on by most Vietnamese banks, which have already developed digital innovation strategies or are in the process of doing so.

Traditionally, Vietnamese banks kept their main focus on products like business loans, but they are now making rapid progress in B2C (Bank-to-Customer) retail services as a result of the relaxation of foreign investment regulations in 2015, the growth of the middle class, and international FDI companies entering the country. Unlike in the past, however, these banks now face challenges in making a profit from opening more branches and ATMs with the emergence of neo and digital banks along with their contactless and personalized services after COVID-19 including BaaS (Bank-as-a-Service).

Differences between digital, neo, and traditional banks (Source: Accubits Blog)

Over the past few years, new digital banks have been introduced in Vietnam due to Timo, Cake, and TNEX partnering with traditional banks.

Since digital banks in Vietnam do not possess banking licenses, they offer financial services by collaborating with other banks as shown below.

Vietnam’s top three digital banks and their partner banks

Timo, Vietnam’s First Digital Bank

Timo, the first digital bank in Vietnam, launched the country’s first digital banking service in 2015, which they co-developed with Viet Capital Bank. Now, in 2023, Timo offers digital banking products through a financial partnership with Vietnam’s VP Bank, utilizing its banking license.

Timo’s early services involved payments and partnerships with large franchises in Vietnam such as 7-Eleven and McDonald’s in an effort to take control of the digital banking market in its growth stage.

Timo’s app and ATM card (Source: Timo’s website)

The outbreak of COVID-19 in 2020 shed an even stronger light on the importance of digital banking, and 2022 saw Timo succeed in securing a $20 million investment led by Square Peg, which made it the digital bank with the largest number of users in addition to being the first digital bank in Vietnam.

The driving factors behind the rise of digital banks like Timo include people opening bank accounts online, branches shrinking in number, the growth of microfinance, and the dramatic expansion of the mobile payment market facilitated by younger generations.

Although a digital bank, Timo has four “hangout” branches in Vietnam. These physical, café-like branches provide assistance in matters like becoming a bank member and taking out loans.

(Foreigners, however, are required to visit a branch in person to open an account instead of doing so online as eKYC verification for foreigners is not yet available in Vietnam.)

Timo hangout cafés (Source: Cong Thuong)

Timo concentrates its efforts on data collection and analysis as well as AI to allow customers to deal with their financial situations in a complete manner and to better understand and satisfy their needs using technology.

The bank, which successfully raised $20 million in funds from Square Peg in 2022, is pursuing the ultimate goal of obtaining an independent digital banking license in Vietnam.

Cake Hits 1 Million Users

Cake is one of the fastest-growing digital banks in Vietnam. Cake Digital Banking, launched in January 2021, is a digital banking application co-developed by VPBank (Vietnam Prosperity Joint Stock Commercial Bank) and Be Group Joint Stock Company.

The app succeeded in attracting 1 million users in eleven months after starting its first service thanks to its addition as a payment option on the Vietnamese car-sharing app “Be,” offering various discounts and promotions.

Cake allows its users to open accounts online, issue debit cards, transfer money using phone numbers, and easily pay a range of bills (including electricity, water, internet, phone, TV, apartment maintenance fees, etc.) via QR codes.

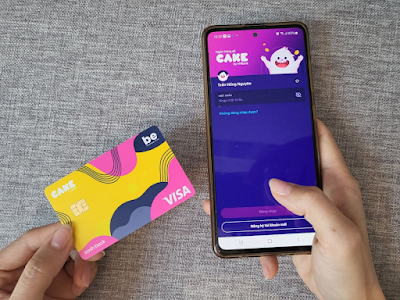

Cake’s mobile app (Source: Baotintuc.vn)

Just like with traditional banks, Cake customers can make withdrawals with no fees at banks connected with NAPAS and at over 21,000 ATMs across the country. After applying, they can have their physical ATM cards delivered within three to four days as well.

Cake’s credit cards (Source: VNexpress)

Most notably, Cake pays its customers interest at an annual rate of 3.6% without requiring them to make deposits, and it has also recently streamlined its procedures for issuing cards through partnerships with Mastercard and VISA.

Cake is currently working on establishing a “lifestyle banking app” to be more than just a digital retail bank, with the aim of providing customers with quicker, easier access to financial services.

In July 2022, the bank won the Core Banking System Initiative of the Year award at the Asian Banking & Finance Retail Banking Awards for its innovative and technology-driven approach.

TNEX: Financial Services for Small Businesses

TNEX, a digital-only bank that started in partnership with MSB, hit 1 million users only a year after its launch in December 2020.

TNEX’s mobile app (Source: Vietnam.vn)

The digital bank’s CEO, Bryan Carrol, a former CDO (Chief Digital Officer) of MSB, founded TNEX with substantial support from MSB’s CEO with the motto of providing financial services for 58 million people, or 60% of Vietnam’s population, who don’t even have access to financial services, including low-income workers, students, small business owners, and those living in rural farming and fishing villages.

As of 2023, 85% of Vietnam’s businesses are small-sized, and they make up 40% of the country’s GDP and 50% of its employment, serving as a huge financial market.

Bryan Carroll, the CEO of TNEX (Source: TNEX’s website)

TNEX started its digital services as a branch-free bank for quick, adaptive customers, mainly targeting millennials and Gen Zers in Vietnam. It aims to establish a financial payment ecosystem linked with games, messages, and social media.

It also launched the TNEX debit card in partnership with MSB, which allows users to withdraw cash without fees at forty-two banks connected to NAPAS and ATMs nationwide.

A TNEX-MSB debit card being used at an ATM to make a withdrawal

(Source: cafef)

Other Banks Planning Digital Transitions

According to the SBV (State Bank of Vietnam) in 2023, starting from 2024, restrictions will be placed on the opening of more branches or new banks, and major Vietnamese banks are undergoing preparations for setting up digital banks.

In addition, the partnerships between digital banks and third parties possessing a large amount of data regarding their loyal customers are expected to lead to more various financial products and tailored customer service.

For example, SOVICO Group’s HD Bank and the airline VietJet are working together to open a digital bank that will offer a range of digital financial products and a BaaS (Bank-as-a-Service) for VietJet’s loyal customers.

** For more detailed information, please contact the ID “go2hanoi” on KakaoTalk.

#VietnamIn #DigitalBanks #VietnamDigitalBanks #Timobank

#cake #tnex #vietcapitalbank #vpbank #msb #hdbank#VietnamBAAS

Vietnam & IT Blogger

Patrick Kim | go2hanoi(kakao), goodserver1@gmail.com, https://www.linkedin.com/in/patrickdykim/

This text was written with the consultation of a legal professional, and it’s important to mention that, due to my non-legal background, there may be subjective opinions in the analysis and interpretation of legal documents. If you have any questions, please contact me using the provided information.

VietnamIn Kim Do-yeon ・ Dec. 03,2023・Goodserver1@gmail.com・Translated and Published by Uptempo Global